Fraser Valley

Mortgage Professionals

Luisa & Candice Mortgages

Customer care is the cornerstone

of our business.

Get In Touch

Luisa Hough

Luisa’s career as a committed mortgage professional spans over 17 years during which time she has helped thousands of Canadians achieve homeownership. Having established a sound reputation for excellence and outstanding service, her astute and genuine approach has allowed her to build and cultivate a trusted clientele and quality referral network.

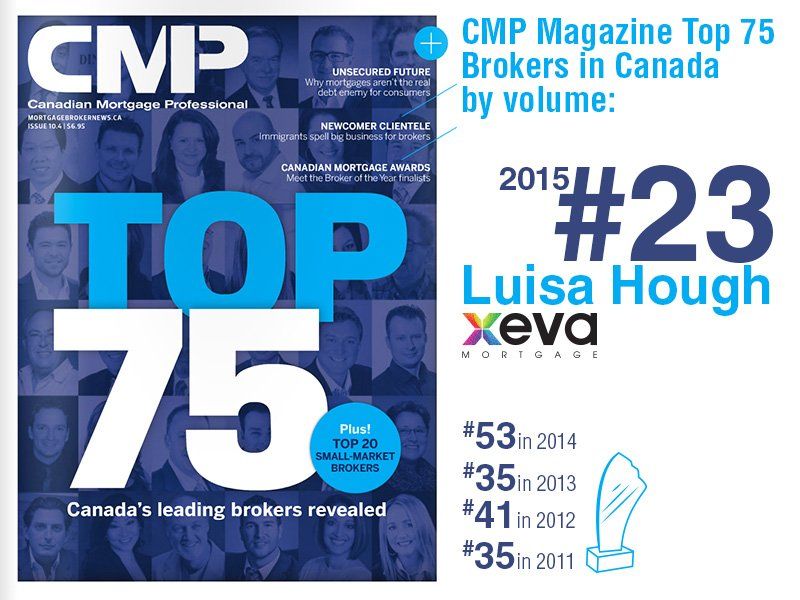

During Luisa’s tenure and as co-founder of one of the most highly respected mortgage companies in Canada and the industry, Verico Xeva Mortgage, she has been instrumental in its continued growth and success through her drive and passion, as well as her solid work ethic and commitment to transparency. This has earned her multiple accolades over the years including Broker of The Year 2016 & 2021, Finalist-Broker of the Year 2013-2021 respectively, Top 75 Broker Nationally for 10 years consecutively, and CMP Magazine’s 2020 & 2021 Hot List. Lastly and most distinctly, by virtue of Luisa’s strong, inspiring leadership, supportive nature, and warm professional manner, she received the Women of Influence distinction in both 2018 & 2020 becoming a trailblazer for many women seeking to emulate the same achievements. As such, Luisa has been invited to share her best practices and collaborate at many different industry events continuously raising the bar and elevating the industry to higher standards. Luisa has helped shape Xeva Mortgage to include a solid infrastructure and unique underwriting center attributing to this consistent success and overall growth.

It’s through Luisa’s resolute process of educating clients and having a great eye for detail, where she can focus on building her client’s financial journey and providing a professional service throughout the life of the mortgage, ultimately assisting Canadians in achieving their full financial goals.

There have been countless changes industry-wide over recent years, notwithstanding, Luisa has been able to achieve a strong and healthy balance between work and family life. Ongoing investment in herself and her personal development is what she attributes to her success both personally and professionally. This has also allowed her to tap into her philanthropic side as she has an incredible passion for charitable endeavors and strongly desires to give back to many initiatives in need. Being a regular donor to the BC Children’s Hospital and her own Pay it Forward campaign, Luisa is also an active member of Habitat for Humanity, 100 Brokers Who Care, and Women of Options. Her shared compassion with 50 other top influential women in Surrey, BC supports the Women of Options Organization in securing affordable housing for women of varying age groups and demographics who may otherwise find themselves homeless. As Luisa continues to grow both professionally and personally, so too does her desire to continue helping those around her who are in need.

Luisa continually inspires others,

has an innovative and open spirit for everyone to learn and share, allowing her to continue making connections with her fellow colleagues and industry leaders for years to come.

Candice Liberatore

Whether you’re in the market for a new home, considering refinancing, or renewing your mortgage, I'm here to help you find the perfect mortgage product tailored to your needs. As a Mortgage Broker at Xeva, I specialize in offering the most innovative home financing solutions available today.

With over 23 years of experience at a major Canadian bank, I have assisted clients like yourself with a wide range of financial needs, including lending, financial planning, advisory services, and commercial banking. Over the past decade, my focus has been on providing expert mortgage advice, recognized for its ethical integrity and exceptional customer service.

My ultimate goal is to ensure your mortgage experience is positive and seamless, inspiring you to confidently refer me to your family, friends, and colleagues. Take advantage of a no-obligation review of your situation—because the right mortgage can significantly impact your wealth and savings. I eagerly anticipate providing you with honest insights and guidance to achieve your homeownership and financial security goals.

On a personal note, I cherish spending time with my husband, four children, and our beloved COVID dog named "Dr" Henry. I'm an avid sports enthusiast, enjoy cooking, and appreciate a good glass of wine. Feel free to reach out anytime—it would be my pleasure to assist you!

See What Our Clients Have To Say

Are you looking to buy a new home, refinance or renew an existing mortgage?

Home Purchase

If you are looking to purchase a property in Vancouver or surrounding areas, understanding all the mortgage options available to you can seem overwhelming. The market is hot and having a clear plan is a must. That’s where we come in. We do this every day, and we love it. We will help you make sense of all the numbers and provide you with options that make sense to you so you can shop with confidence.

Contact us anytime!

Renewal or Refinance

Whether your mortgage is up for renewal within 120 days and you are looking to get the best available mortgage product for your next term, or you are mid-term looking to access some of the equity in your property to start a new business, we should talk! If you already own a home and want to make sure you have the best mortgage in place, please contact us anytime! Regardless of your situation, we have the knowledge, experience, and desire to make sure you are completely taken care of.

Repeat or New Clients

If you are an existing client of ours, we are excited to continue working with you to make sure you have the best mortgage product available to you at any time. Please drop a note in the contact box at the bottom of this page, even if it’s just to say hello! However, if you have never used our services, we are currently taking on new clients and would love to offer you the same level of service all our existing clients receive. To see what others have said about us, consider

checking out the testimonials section below!

55+ and looking for solutions to enhance your lifestyle?

I offer multiple options including Reverse Mortgages, HELOC, standard and private financing to find the right retirement mortgage option for you.

I keep my blog updated regularly so you can stay informed

Videos

If you are new to the mortgage process, here are a couple of videos to help you get started.

Awards

Recent Awards

- 2021 Canadian Mortgage Awards Winner- Mortgage Broker of the Year

- 2020 Canadian Mortgage Awards Finalist - Mortgage Broker of the Year

- 2019 Canadian Mortgage Awards Finalist - Mortgage Broker of the Year

- 2016 Canadian Mortgage Awards Finalist - Mortgage Broker of the Year

- 2015 Canadian Mortgage Awards Winner Xeva – Best Newcomer Brokerage

- 2014 Best of Now Magazine – Readers Choice Best Mortgage Broker Winner

- 2013 Vancouver 5 Star Mortgage Professional

- 2013 First National Financial LP Outstanding Achievement Award

- 2013 Vancouver Magazine – Top Mortgage Professionals

- 2012 CMP Awards – Syndicate Mortgages Mortgage Broker of the Year Fewer than 25 Employees

- 2011 CMP Awards – “Broker of the Year” Finalist

- 2010 CMP Magazine Top 50 Brokers in Canada by volume. Rank 30th

I am proud to have developed incredible working relationships with several Canadian mortgage lenders. Let's find out which one has the best mortgage product for you!

Working together to make a difference!

Each quarter we donate $10,000 to a worthy cause.